![[object Object]](https://modus-made-dev.cdn.prismic.io/modus-made-dev/1c8f9c2e-0790-41f9-bbd6-cf56d39daf1d_payomatic-logo.svg?fit=max&w=220&h=34)

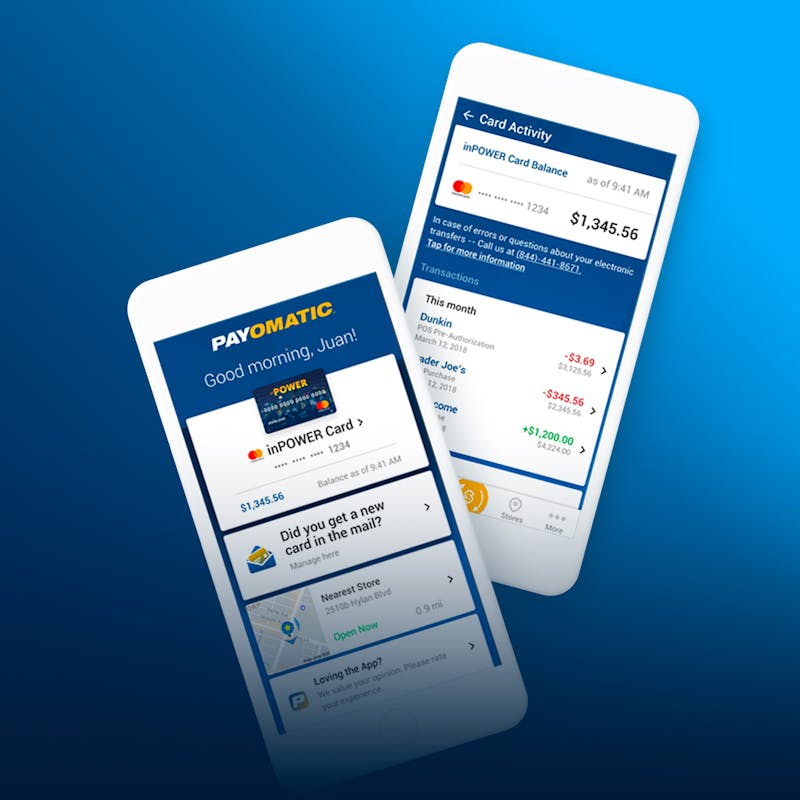

Taking fintech from retail stores to the cloud

In the financial services world, change is the name of the game -- but that’s a challenge when it involves a business-critical enterprise platform. For the past 10 years, FinTech leader Payomatic has relied on Modus to help its business-critical systems evolve in the right direction.

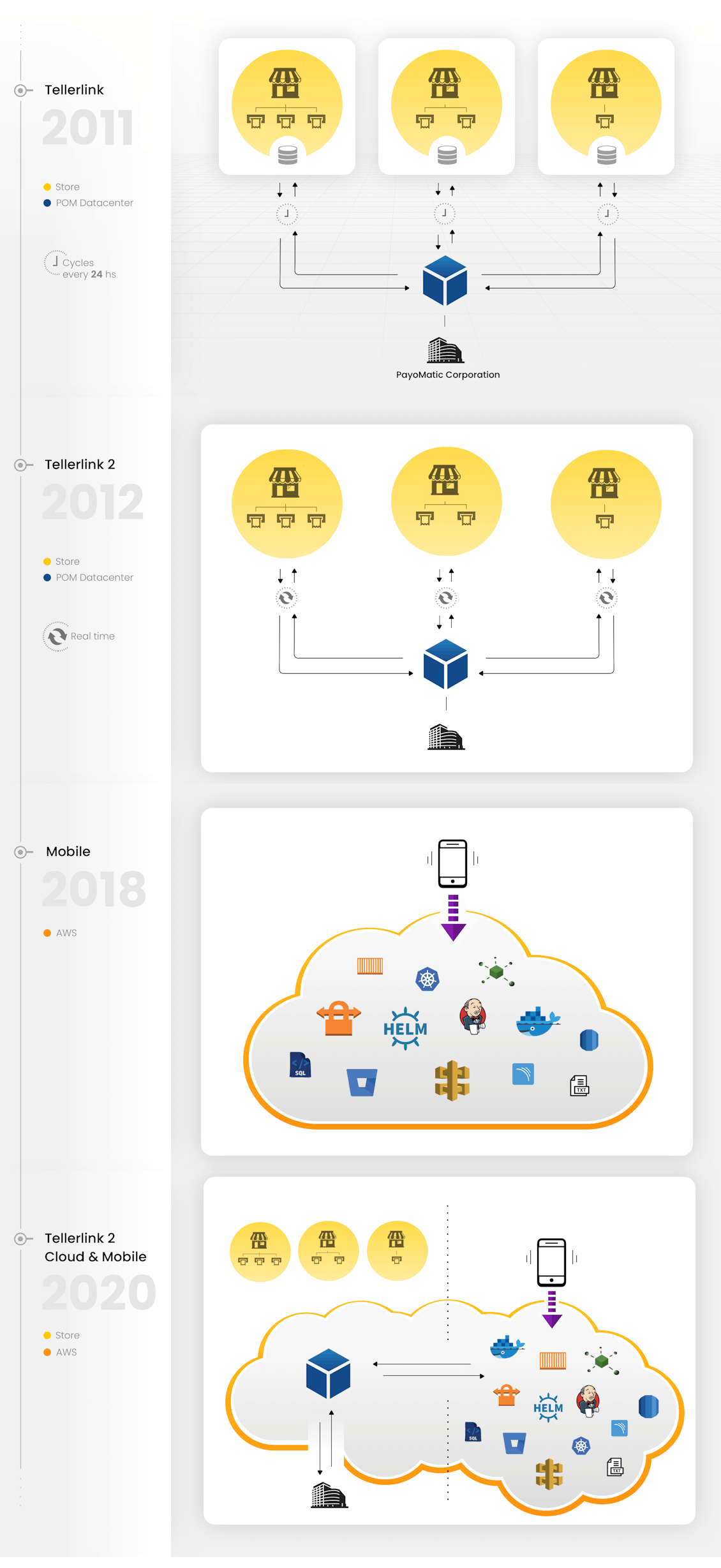

Initially, the 150-storefront 24x7 check-cashing and financial services retailer’s on-premise servers and databases were uploaded to a central server, reconciled, then downloaded back to each store -- every night. The first technical evolution of this platform involved migrating this disconnected batch-oriented system to an enterprise MVC architecture with real-time data processing that essentially eliminated double presentment of checks and related fraud.

As pressure increased for their business and digital platform to expand beyond the store and into mobile, the next stage of their technical evolution began: moving from the monolithic MVC architecture and the data from one single big relational database to microservices and multiple databases and different types of storage more suitable for the work in the cloud.

In addition to a more scalable system, microservices enable Payomatic to extend their Point of Sale platform to enable multi-channel customer identification - all while meeting stringent NY Security and Privacy regulations and reducing hosting costs. What’s next? Continued evolution of the platform with the right technology at the right time.

We're proud to be part of 10+ years of evolution and constant adoption of new technologies, with the shared goals of providing the best customer experience and increasing business efficiency.

Juan Speziale / Director of Engineering / Modus